Entrepreneurial

Corporate Finance

Mergers & Acquisition Projects

Compass Capital develops projects in niche market segments

that are underresearched or overlooked and offer either

outsized growth or transformative restructuring opportunities.

In addition to that, our principals represent interests of private family offices,

for which they search and source interesting new investment ideas.

Phone

+41 41 552 05 58

Office

Lindenstrasse 14

CH-6340 Baar Switzerland

a Partner for entrepreneurs and institutions

Our Values are at the Core of our Activities

When it comes to developing new investment projects or strategies, the key foundation for successful implementation is mutual trust and respect.

Trust is forged by values and their consequent implementation.

We strive to adhere to our core values:

"sober passion"

The late Chancellor Helmut Schmidt coined a beautiful term:

„Nüchterne Leidenschaft zur praktischen Vernunft.“ –

i.e. a „sober passion for practical rationality“.

A concept to which we strive to live up to in all our business endeavours.

inspiration & vision

Innovation has started to massively accelerate since the turn of the millenium. It is necessary to think out of the box, dream big and develop new visions for many industries in order to thrive in this new world that is only emerging yet!

reliability & integrity

The trust that develops from reliability and integrity cannot be bought, it can only be earned over time. Keeping your word, being loyal and striving to deliver what is necessary to build and earn the trust of our partners and clients is key to all our activities.

sustainability

Sustainability means meeting the needs of the present without compromising the ability of future generations to meet their needs. The concept of sustainability is composed of three pillars: economic, environmental, and social—also known as profits, planet, and people.

Sustainability makes good business sense, and we strive to consider the impact of our business decisions towards all stakeholders.

Read more at https://www.brainyquote.com/quotes/paul_polman_887123

Read more at https://www.brainyquote.com/quotes/paul_polman_887123

attention to detail

History shows that high-profile investments have miserably failed because its proponents and investors failed to think through, vet and fact-check some seemingly minor but nevertheless critical details. From Madoff to Theranos: it would have been possible to avoid the failure if one would have had asked the right questions, without inhibitions. Once a project, strategy or method starts to attract our interest, we tend to single-minded attention to detail once you have figured out the grander vision and milestones. This especially applies to due diligence.

A unique Partner

You will get a reliable and determined partner for your projects that unites a unique practical, bottom-up and hands-on startup and bootstrapping experience with a broad, top down perspective on multi asset class investments and multi-cycle experience.

years of multi startup experience

years of multi-asset class investment experience

%

multidisciplinary and out of the box thinking

determined to win

What We Do For You

Compass unifies a broad variety of competencies through a network of experienced investment professionals, sector specialists and entrepreneurs, as well as contractors who support us and allow us to allocate our resources in a highly efficient way.

- If you are a Qualified Investor: we identify and evaluate interesting and novel investment opportunities and introduce them to you.

- If you are an Entrepreneur: if your project meets certain requirements, we will help you to formulate a business plan, a funding concept and will introduce you to suitable investors.

- If you are a Family Office or represent an Institutional Investment Board, we bring hands-on, multi-cycle and multi-asset class experience coupled with truly independent thinking to your investment decision process.

for family and pension commitees

Navigating the Complex Investment Landscape

Since the containment of the Great Financial Crisis of 2008, we live under some sort of an economic state of emergency: both, quantitative easing and negative interest rates are used to stabilize financial markets and economies, and create a subtle environment of financial repression.

In this context, any investor is well advised to not blindly invest in those concepts and asset classes that have worked well in the last 10 or 20 years, but to question the status quo of the consensus and think about alternatives.

For more than a decade, Compass has not only successfully traded hedging strategies throughout the panic points of the great financial crisis, but also evaluated a big variety of strategies and managers across many asset classes and therefore brings unparalleled practical market experience to the table of any board or investment committee that is looking for hands-on advice or is looking to evaluate novel investment approaches.

We offer:

- product- and bank independent advice and critical review of investment products and offerings based on our deep and broad experience

- a non-conventional, behavioural view on markets

- out-of-the box thinking about geoeconomic dynamics

- anticipatory rather than reactive approaches.

for entrepreneurs

Developing Entrepreneurial Opportunities

Having founded two companies ourselves, and having participated in the supervision of many others in startup, growth and turnaround stages, we can bring a cumulative experience of more than 15 years of startup and bootstrapping experience to ambitious new founders who are looking for a combination of hands-on entrepreneurial as well as financial perspectives.

In today’s markets, entrepreneurs are often highly specialized within their respecteive niches. They need board members and advisors who provide them with broad perspectives and hands-on experience. They also need someone who helps them to draft their story and concept so that it becomes appealing to investors.

We help aspiring entrepreneurs with

- sharpening strategy and value proposition

- making their proposition more appealing to investors

- sharpening an shapeing their management team

- linking them up with investors and business partners.

for institutional size investors

Sourcing Innovative Investment Solutions

Through our network in the family office and institutional investor world, we are – now and then – able to identify uniquely positioned investment solutions that might be appealing to sophisticated asset allocators and we introduce them to suitable investors to complement their portfolios.

When selecting these kinds of opportunities, we are always looking for a unique edges of such managers or solutions, like:

- informational or structural advantage in otherwise inefficient or illiquid markets

- activity in promising but neglected or unrecognized niche markets that still offer a large enough opportunity set.

- harnessing the power of big data and digitalization to approach well-established markets or investment sectors with a new kind of effectiveness or efficiency.

- novel approaches to exploit and/or hedge behavioral phenomena in traded markets.

high growth / consolidation opportunities

Current Projects and Entrepreneurial Investment Propositions

Important Disclaimer: All our opportunity projects will only be introduced to professional, accredited qualified investors or industry participants such as institutional investors, platform companies, family offices or independent asset managers.

You will find our current projects and themes to the right.

Consolidation Projects in the SWiss independent asset management, TrusT and Fiduciary market

Compass Capital has created one of the most comprehensive market mapping and research efforts on the Swiss market for Independent Asset Management, Trust, Fiduciary and Corporate Serivces and carries out projects with dedicated project sponsors to consolidate this market segment.

identifying opportunities in the "future of healthcare" segment

The drive towards value-based healthcare and innovative outcome-oriented medical solutions opens up a whole new opportunity set.

Newly emerging applications and technology platforms will open up a whole new spectrum to treat unmet clinical needs and enable the investor to profit from the ongoing healthcare revolution. We have identified promising new investment opportunities that will be shaping the future of medicine already today.

Call to Explore

If you are a Family Office, a dedicated Entrepreneur or an Institutional Size Investor, call us to explore attractive new opportunities or let us show you how wan can bring out of the box thinking

into your investment process and comittee.

project setups

How we can support you:

- If you are a Qualified Investor: we identify and evaluate interesting and novel investment opportunities and introduce them to you.

- If you are an Entrepreneur: if your project meets certain requirements, we will help you to formulate a business plan, a funding concept and will introduce you to suitable investors.

- If you are a Family Office or represent an Institutional Investment Board, we bring hands-on, multi-cycle and multi-asset class experience coupled with truly independent thinking to your investment decision process.

“Look for people who have lots of great questions.

Smart people are the ones who ask the most thoughtful questions,

as opposed to thinking they have all the answers.

Great questions are a much better indicator of future success than great answers.

It is far more common for people to allow ego to stand in the way of learning.”

Ray Dalio, Principles

strategic location

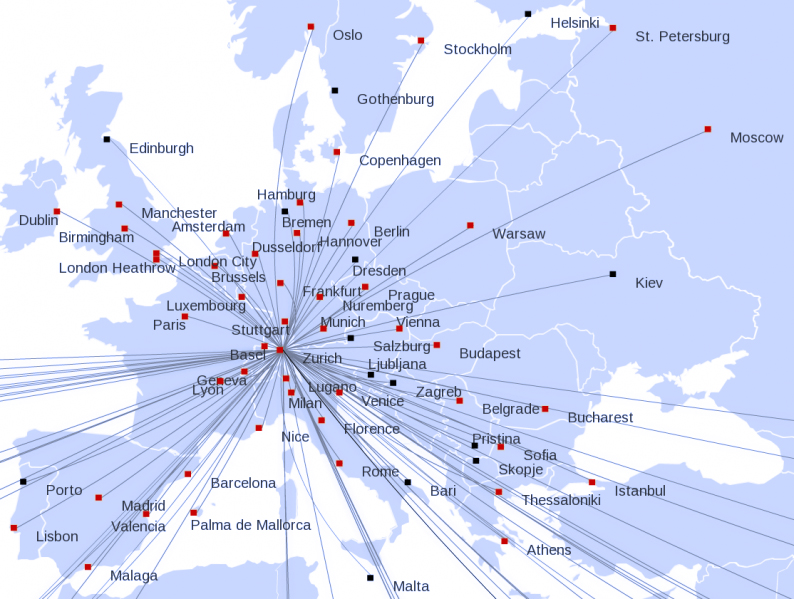

Switzerland:

in the Heart of Europe

The Zurich-Zug region is one of the most innovative European regions and provides a unique entrepreneurial environment with an extremely stable legal environment, business friendly regulation and workforce – and favourable tax regime.

In addition to that, Switzerland is strategically situated in the very heart of Europe: most major cities can be reached in only 1-2 hours of flight.

F.A.Q.

Some Common Questions

We are looking for independent expertise for our board or commitee. What is your edge?

Our unique edge is the combination of very hands-on „micro“ with very top down, holistic and unconventional „macro“ – and having successfully foreseen and implemented hedges during both, the Great Financial Crisis of 2008 and the Euro Crisis of 2011, we have developed unique deep experience – other than most „armchair generals“ who tend to talk a lot….

what is your unique experience in entrepreneurial investments?

Our principal has started and led two companies in the research and asset management business for 8 years each. During this time, he accumulated hands-on bootstrapping and leadership experience.

I have just sold my company. How could you help me with my investments?

We will provide you with an overall concept for a highyl diversified portfolio that incorporates your need for recurring cashflows as well as your requirements for growth investments.

I have a great new technology but no investors. How could you support me?

Depending on which sector you are in, we could either help you ourselves or could put in you in touch with experienced fundraisers or investors who could. Also, we can help you in developing an investor-ready concept and business plan if your concept seems to be sufficiently attractive to us.

Get In touCh

Schedule an Appointment

Entrepreneurial Projects

Developing technology growth opportunities.

Investment Solutions

New solutions and opportunities for asset allocators.

Investment Advisory

Outside of the box contributions for your investment comittee and process.