Mergers & Acquisitions

We find the companies you want to buy –

or vice versa!

Partner for entrepreneurs

Our values – our foundation

When it comes to developing new projects with our clients and their potential partners, we see mutual respect and trust as the most important foundation.

In our view, trust is earned through the consistent implementation of tried and tested values:

"Sober passion"

The former German Chancellor Helmut Schmidt coined a beautiful term:

“Sober passion for practical reason.”

A concept that we try to live up to in our undertakings.

Reliability and integrity

The trust that comes from reliability and integrity can only be earned over time.

For us, keeping our word, being loyal and doing what it takes to earn trust are the basis for successful, long-term relationships with our business partners.

Innovative spirit

Since around 2010, innovation has begun to accelerate massively. It is necessary to proactively embrace innovation and new technologies.

A completely new world is emerging and the business logic needs to be rethought. However, not all small companies can make the necessary investments on their own!

Sustainability

Sustainability means meeting the needs of the present without jeopardizing the ability of future generations or other stakeholders to meet their needs. The concept of sustainability consists of three pillars: Economic, environmental and social – also known as profits, planet and people.

Sustainability makes good business sense and we strive to consider the impact of our business decisions on all stakeholders.

Read more at https://www.brainyquote.com/quotes/paul_polman_887123

Read more at https://www.brainyquote.com/quotes/paul_polman_887123

Attention to detail

History shows that high profile investments have failed miserably because their proponents and investors failed to think through, scrutinize and base some seemingly insignificant, yet critical details on facts. From Madoff to Theranos: it would have been possible to avoid failure if the right questions had been asked, without inhibitions. Once a project, strategy or method has piqued our interest, we tend to pay single-minded attention to detail once you’ve identified the bigger vision and milestones. This applies in particular to due diligence.

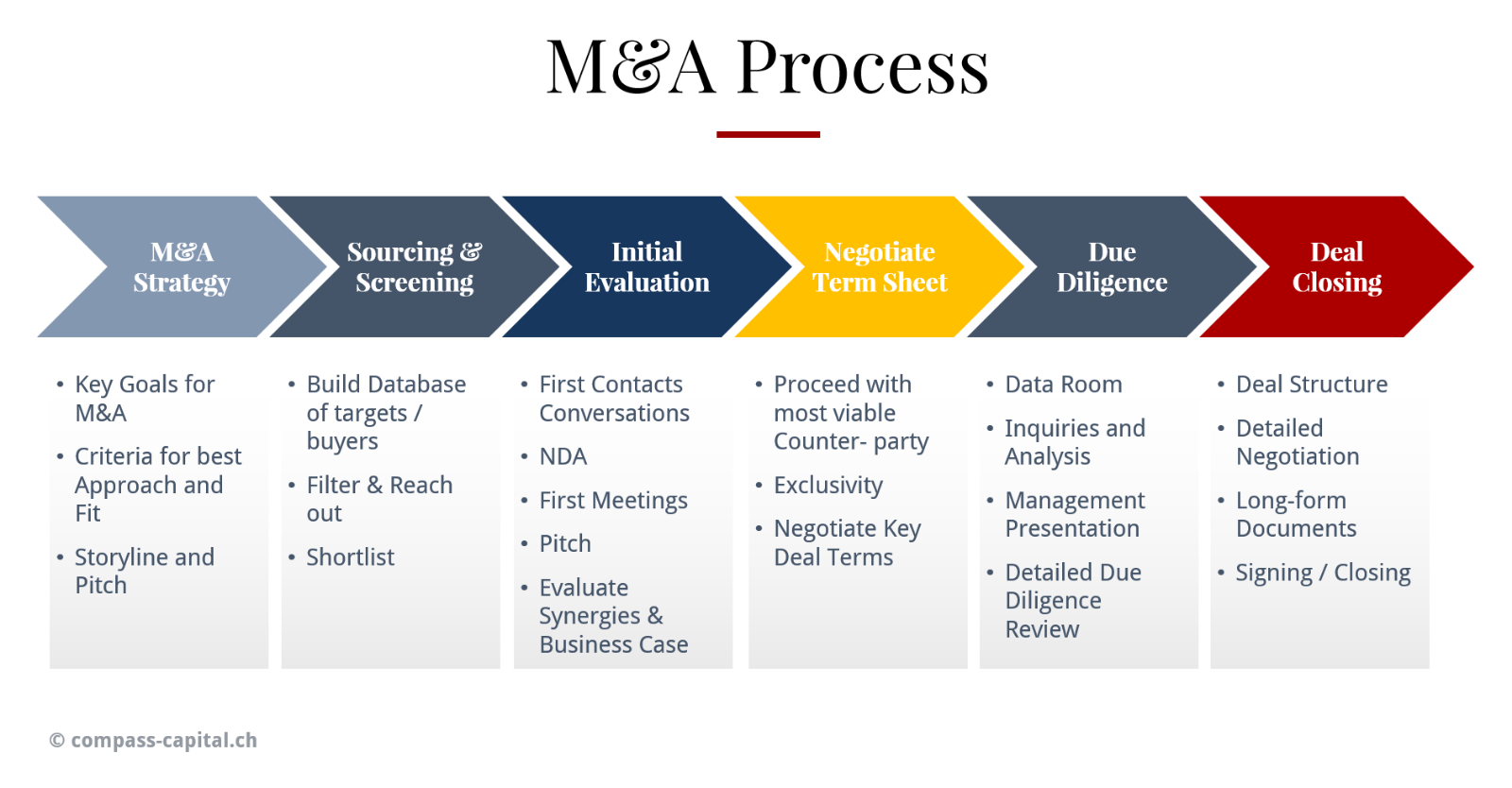

Process overview

Value creation through M&A

The Compass team helps entrepreneurs find the right partners to create value through corporate finance transactions.

Whether you want to sell your company, find strategic investors or buy and integrate other companies yourself, Compass supports you with a systematic and structured approach.

We help with strategy formulation, identifying buyers or buying opportunities through a sophisticated and broad search process based on decades of research experience.

Once potential partners have been found, Compass supports the negotiations, due diligence, valuation and structuring of the deal through to a successful conclusion.

Use of the latest tools

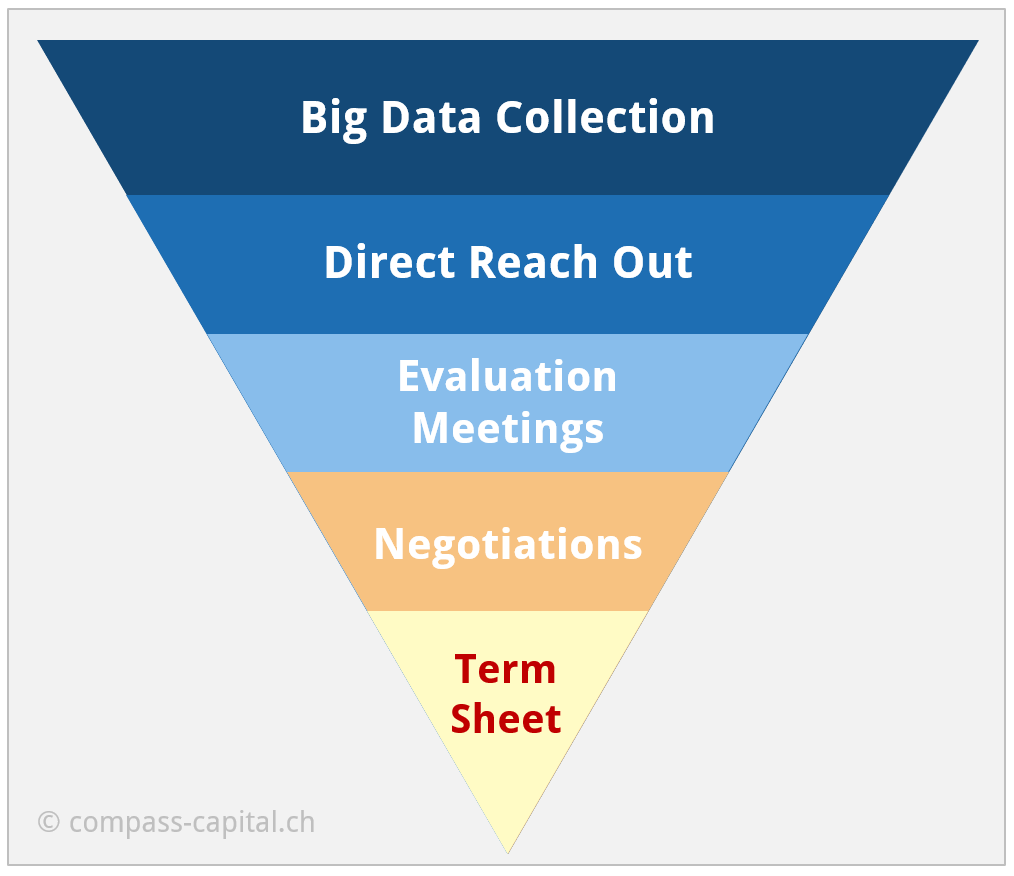

The search for the right partner

Our decades of experience with direct industry research and contacting key decision makers enables us to identify and develop potential partners or targets for our clients with a high degree of efficiency.

We use a wide range of research tools, and for markets that do not have the necessary transparency, we have developed a data collection function that allows us to create our own data set very quickly by retrieving data from various relevant sources.

We endeavor to find and bring together those partners for whom transactions make sense not only from an economic, but above all from an interpersonal point of view.

Customized support

Transaction support

We offer our buy-side and sell-side clients comprehensive support in M&A transactions by combining our extensive experience in executing M&A transactions with strong business acumen and in-depth legal expertise:

Negotiations

Analysis of the parties’ positions, negotiation tactics, identification of potential obstacles and development of creative solutions before these become obstacles to negotiations.

Communication

We are happy to be the professional voice in the negotiations and defend our client’s positions fiercely so that they can maintain a good business relationship with the other party at the same time.

Rating

Application of various standard market valuation methods.

Structuring

We assist our clients in navigating possible suitable transaction structures and work with their legal and tax experts.

Project management

We offer project management support for specific workflows or for the entire project, depending on the specific needs of our clients.

Review of the documentation

We are the second party that reviews the transaction documents to ensure that they reflect our clients’ business understanding and to avoid unwanted surprises after closing.

Unique combination of expertise

Experienced, entrepreneurial team

The two partners Daniel Menet and Benedict Götte have known each other for more than two decades and together have well over 40 years of experience in transactions.

Benedict J.P. Götte

Partner

Research and analysis, project management, reachout, contact initiation, moderation.

Valuation, due diligence.

ICCF Columbia, CAS Turnaround HSLU, M&A Certificate Imperial College, University of St. Gallen.

Entrepreneur and VC / PE Investment Manager, Armada Investment Group, Venture Partners, Infosearch LLC.

Daniel A. Menet

Partner

Deal structuring, strategic and tactical negotiations, project management, due diligence, comprehensive analysis of transaction documents.

Lic.iur., LL.M., Attorney at Law, NY

University of Fribourg, Fordham University

Eagles Rock Advisers, Access Industries, RTL Group, McDermott Will & Emery.

Support Staff

The experienced core team is also supported by 3 outsourced employees in the areas of research, analysis and data preparation.

Alongside his studies, Benedict Götte founded the research company InfoSearch, which dealt with market, competition and technology analyses in business-to-business markets. He then worked for Venture Partners and the single family office Armada Investment Group, where he carried out various private equity transactions. He has been conducting M&A transactions in the small-cap market for several years.

His specialty is searching and finding potential partners even in opaque markets through a combination of a very broad network, various big data-oriented research methods and his own approach to engaging potential targets.

Daniel Menet is an M&A expert with over 25 years of deep and broad transaction experience. He manages and negotiates complex and cross-border transactions, including acquisitions, divestitures, joint ventures and venture capital investments. One of his core competencies is his comprehensive understanding of all transaction elements, which he brings to negotiations in a target-oriented manner.

Daniel built up RTL Group’s M&A team in Luxembourg and managed it for several years. He oversaw RTL Group’s investments in the digital sector with a success rate of over 70% (85% after LoI).

He is also an experienced lawyer and was a partner in the New York office of one of the leading US law firms.

Testimonials

Selection of recent transactions

Below we present some of our more recent transactions with testimonials from our clients.

Brendan Donahue, General Counsel,

Central European Media Enterprises:

“Compass Capital Luxembourg (trading as “Eagle’s Rock Advisers” at the time of the transaction) supported us in navigating a complex multiparty bidding process. They stayed very close to the process and provided us with valuable insights, competent advice and guidance, which led to CME being the winning bidder for RTL Croatia.

Compass’ focused and highly professional approach in deblocking difficult deal situations and bringing the deal to the finish line is unique.”

Compass advised CME Media Enterprises BV on the acquisition of RTL Croatia – a major strategic move by CME that strengthens its position as one of the leading media and entertainment companies in the Central and Eastern European region to 6 countries, 42 channels and a reach of 49 million viewers.

Alain Esseiva, Chairman & CEO, Alpadis Group:

“We were pleasantly surprised by how quickly Compass was able to generate meaningful leads for our acquisition in the Swiss trust and fiduciary sector, a market characterized by its highly fragmented, discrete and opaque nature.

Compass provided us with extremely professional and service-oriented support during the execution of the transaction and we will certainly continue to use their services for future projects.”

Rico Decimo, founder and CEO, Decimo Immobilien AG:

“We found the collaboration to be competent, flexible and efficient.

We also very much appreciated the fair and cooperative attitude – and will recommend Compass at any time.”

Markus Wintsch, CEO and shareholder, swisspartners Group:

“With its systematic search process, Compass delivered on time and found a partner in Decimo Immobilien that was a perfect fit for us.”

Thomas Rutishauser, CEO and founder, NRS Treuhand AG:

“At the time when Compass – surprisingly – contacted us, a merger was not on the agenda for our company at all.

After a gradual mutual rapprochement, we recognized the advantages that a merger with Swisspartners offers for both sides and are now looking forward to the new strategic perspectives.”

Markus Wintsch, CEO and shareholder, swisspartners Group:

“With its systematic search process, Compass delivered on time and found a partner in NRS that was a perfect fit for us.

In addition to the technical aspects, Compass always emphasized the human aspects of the M&A process, which made a significant contribution to the success of the transaction.”

Further project examples in various sectors. which we have successfully implemented, on request.

The first step:

Let’s open the dialog!

Successor solution

Perhaps you would like to introduce and prepare your succession step by step?

Connection / Integration

If you would like to bring your company into a somewhat larger, but still medium-sized Swiss industry player in order to achieve more together.

Company sale

If you want to set off for new shores.

Yes, please contact me for an appointment:

Telephone

+41 41 552 05 58

Adresse

Lindenstrasse 14

CH-6340 Baar Switzerland